Projects

Katana aims for the creation of new values through the utilization of marketing know-how and the further enrichment of Japan. Here are some of our projects.

Realizing new growth in mature markets

Marugame Seimen: Toridoll Holdings Corporation

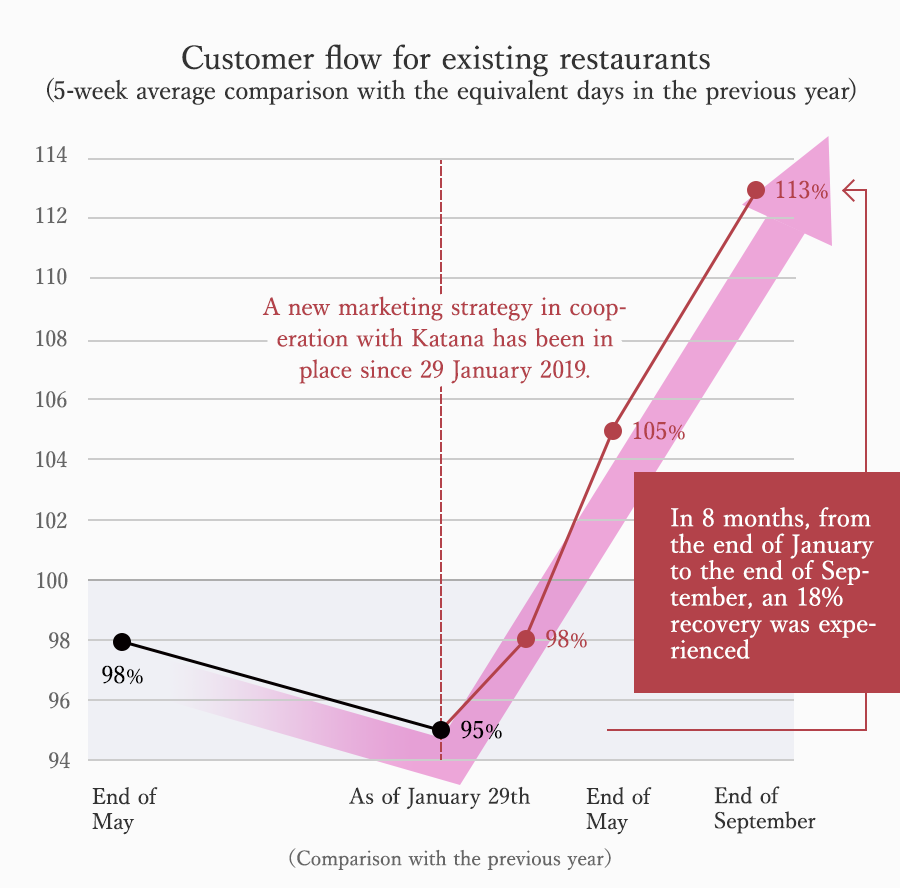

We achieved an 18% growth in a short period of time through reconstruction of the brand.

As a result of the decreasing population in Japan, the restaurant industry is becoming increasingly competitive, and Marugame Seimen is an established player in the market with its udon noodles, a commodity product. Nearly 20 years after its foundation, the restaurant had grown to over 800 stores across the nation, yet customer numbers indicated its struggle, with a year-to year decline for 16 consecutive months.

As a result of the decreasing population in Japan, the restaurant industry is becoming increasingly competitive, and Marugame Seimen is an established player in the market with its udon noodles, a commodity product. Nearly 20 years after its foundation, the restaurant had grown to over 800 stores across the nation, yet customer numbers indicated its struggle, with a year-to year decline for 16 consecutive months.

Note: the number of customers in May 2019 is a net figure, excluding a boost in customers related to the Super Friday campaign in cooperation with Softbank.

Innovating key industries of Japan with consumer-driven values

Key industries have long supported the nation of Japan, and we pour our know-how of consumer values into these industries. We aim to realize growth in Japan with these industries as a starting point.

Norinchukin Group Norinchukin Value Investments Co.,Ltd.

Introducing “marketing” to the finance industry, spreading “investment that is not venture”, and working together to enrich the Japanese people

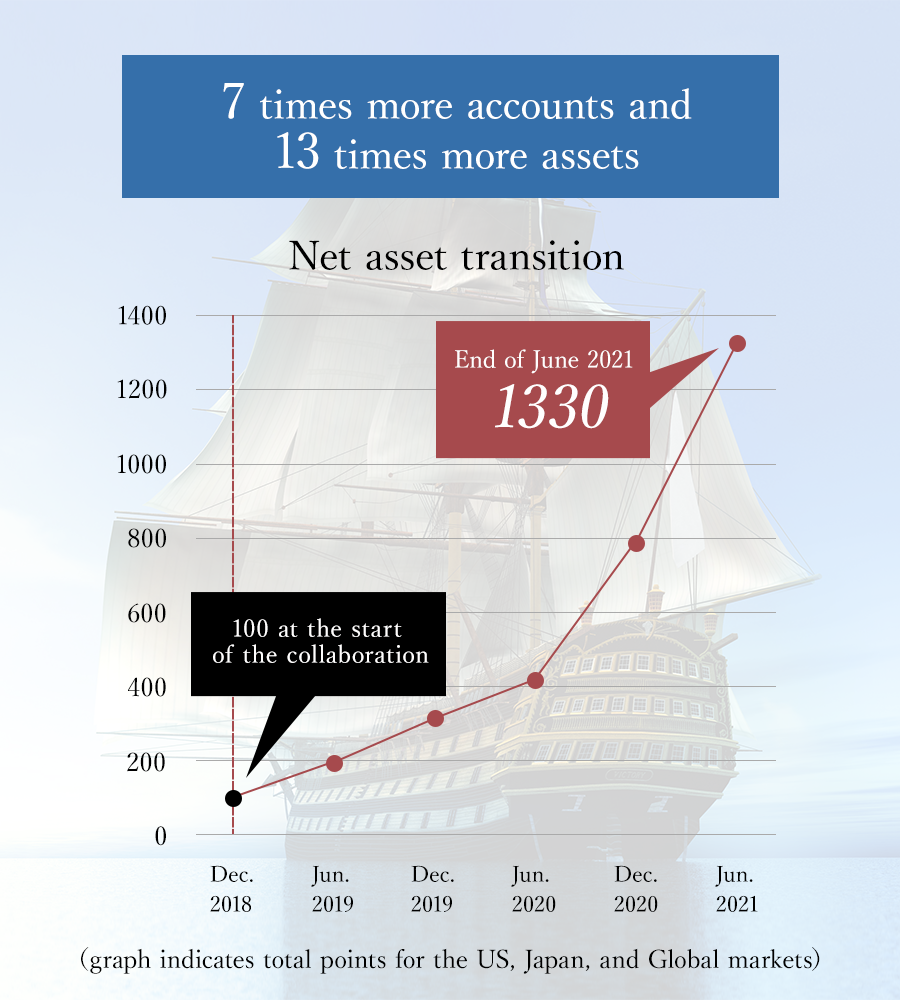

Norinchukin Value Investments (NVIC) is an investment management division of the Norinchukin Group, which offers financial services to many people through group platforms such as JA Bank, and is working in cooperation with Katana to broaden opportunities, encouraging their customers to invest in carefully selected business as long-term rather than short-term “venture” deals. This helps to create portfolios of personal assets, meaning their goal is to help customers live a comfortable and assured life. Katana cooperated in the brand re-development of their trust investment Obune series, which has continued to grow under the policies of fund manager Kazushige Okuno, and now has seven times more accounts and 13 times more net assets (as of July 2021). We remain in cooperation towards further growth, not only through the advertisement of their products, but also the promotion of the idea of long-term investment and establishment of support for it, relating to the reduction of the deep-rooted “investment allergy” of Japanese people.

Norinchukin Value Investments (NVIC) is an investment management division of the Norinchukin Group, which offers financial services to many people through group platforms such as JA Bank, and is working in cooperation with Katana to broaden opportunities, encouraging their customers to invest in carefully selected business as long-term rather than short-term “venture” deals. This helps to create portfolios of personal assets, meaning their goal is to help customers live a comfortable and assured life. Katana cooperated in the brand re-development of their trust investment Obune series, which has continued to grow under the policies of fund manager Kazushige Okuno, and now has seven times more accounts and 13 times more net assets (as of July 2021). We remain in cooperation towards further growth, not only through the advertisement of their products, but also the promotion of the idea of long-term investment and establishment of support for it, relating to the reduction of the deep-rooted “investment allergy” of Japanese people.

*as of July 2021

Online medical service: High Blood Pressure e-medical

From the first consultation, this service offers high blood pressure medical care that is conducted completely online, with no need for in-person visits. Contributing to the enhancement of healthy life expectancy with essential "long-term continuous treatment," this service significantly changes the structure of the industry.

This online consultation service specializes in the chronic diseases often resulting from high blood pressure. It operates online from the first session, and the “convenience of not having to go to the hospital,” combined with online prescriptions and continuous medical care through the application and home blood pressure monitor. The service offers the comfort of “being connected and receiving necessary care,” as a new option for long-term continuous treatment of high blood pressure, which is one of the greatest mortality risks facing Japanese people.

With its unique marketing know-how, Katana set up High Blood Pressure e-medical service, in collaboration with specialized partners with expertise, in order to provide the best consumer experience in the medical field.

This online consultation service specializes in the chronic diseases often resulting from high blood pressure. It operates online from the first session, and the “convenience of not having to go to the hospital,” combined with online prescriptions and continuous medical care through the application and home blood pressure monitor. The service offers the comfort of “being connected and receiving necessary care,” as a new option for long-term continuous treatment of high blood pressure, which is one of the greatest mortality risks facing Japanese people.

With its unique marketing know-how, Katana set up High Blood Pressure e-medical service, in collaboration with specialized partners with expertise, in order to provide the best consumer experience in the medical field.

Reviving the economy of Japan through regional revitalization

Seibuen Amusement Park Renewal Project

Establishing a “brand of choice” from the consumers’ point of view, and leading to a successful reopening during the Covid pandemic.

Marking the 70th anniversary of the Seibuen Amusement Park, a renewal project was launched, aiming to bring back the liveliness that had once been cherished. From Seibuen as a starting point, the vision of the program is for different businesses in the Seibu group to coordinate to revitalize Tokorozawa and eventually the entire Kanto region, positioning Japan as a major tourist destination. Cooperating alongside the Chairman and Representative Director of Seibu Holdings Inc., Takashi Goto, Katana’s strong vision of the establishment of sustainable business in the area revitalizing the economy is being pursued. After a total investment of 10 billion yen, and approximately four years of examination and development starting in 2017, Seibuen reopened in May 2021.

Marking the 70th anniversary of the Seibuen Amusement Park, a renewal project was launched, aiming to bring back the liveliness that had once been cherished. From Seibuen as a starting point, the vision of the program is for different businesses in the Seibu group to coordinate to revitalize Tokorozawa and eventually the entire Kanto region, positioning Japan as a major tourist destination. Cooperating alongside the Chairman and Representative Director of Seibu Holdings Inc., Takashi Goto, Katana’s strong vision of the establishment of sustainable business in the area revitalizing the economy is being pursued. After a total investment of 10 billion yen, and approximately four years of examination and development starting in 2017, Seibuen reopened in May 2021.

TM & © TOHO CO., LTD. ©TEZUKA PRODUCTIONS

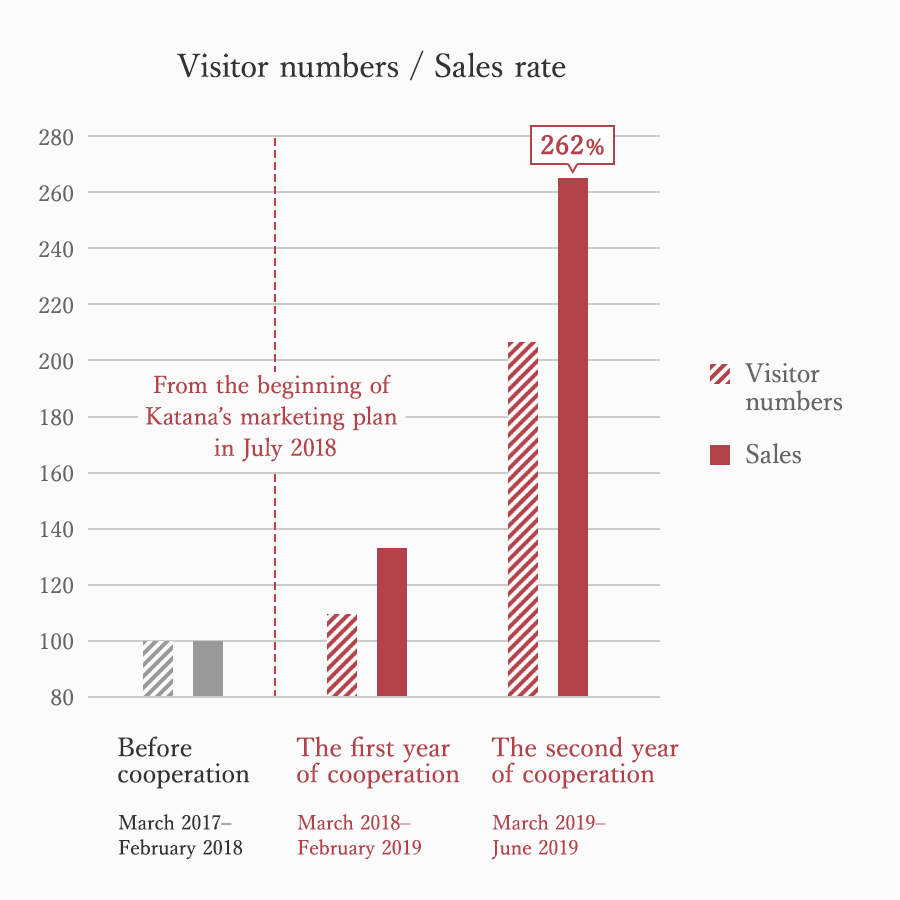

Cooperation with Nesta Resort Kobe

Formerly the Green Pia Miki Regeneration Project. Upon the introduction of Katana marketing, numbers of both visiting customers and sales increased by over 200% in just a year, evidencing a V-shaped recovery. What is more, it achieved its first operating profit during the Covid pandemic.The large-scale recreation center Green Pia Miki was created with the utilization of an enormous amount of funds derived from pensions in the 1980s, but later became a business failure. It was reopened as Nesta Resort Kobe in 2016 under a new owner who aims to contribute to the local economy. The new owner decided that a high level of marketing expertise was required to solidify the profitability of the consumer facility, and approached Katana for support.

The regional revitalization that Katana aims for centers on creating sustainable business in the area through the power of marketing as a spark for Japan’s activity. Green Pia Miki was an extremely difficult project of reconstruction that no one knew how to approach, yet it has become a precious asset for the region. Whether Green Pia Miki failed and ceased to exist, or if Katana’s know-how spurred a big turnaround and a sustainable business – what differences to the regional economy would these two potential paths effect? The significance of this project is seen through broadening the leisure options and enriching the lives of consumers in Kansai. Katana began cooperating in this regional revitalization project for the improvement of Hyogo, the home town of Morioka, in 2018.

The regional revitalization that Katana aims for centers on creating sustainable business in the area through the power of marketing as a spark for Japan’s activity. Green Pia Miki was an extremely difficult project of reconstruction that no one knew how to approach, yet it has become a precious asset for the region. Whether Green Pia Miki failed and ceased to exist, or if Katana’s know-how spurred a big turnaround and a sustainable business – what differences to the regional economy would these two potential paths effect? The significance of this project is seen through broadening the leisure options and enriching the lives of consumers in Kansai. Katana began cooperating in this regional revitalization project for the improvement of Hyogo, the home town of Morioka, in 2018.

Okinawa Theme Park Project

Regional revitalization is the creation of sustainable business in an area. For Japan and Okinawa, we want to establish a “point of change” for 50 years, attracting the fast-growing wealthy class of Asia and making Okinawa a top tourist destination in the region. Leading from this vision, Katana plans a theme park that is irresistible to customers and that supports SDGs and the solutions to various social issues in Okinawa while breathing new life into its economy. It engenders projects that will eventually contribute to the advancement of Japan’s tourism industry.

Nature Live's “Cuisine Glamping” is a groundbreaking approach to the glamping experience, elevating the culinary aspect of camping.

As one of Katana’s models of local revitalization, we have developed a cuisine glamping project, Nature Live, specializing in food experiences that allow cooking novices to “cook for themselves and eat” at the level of professional cuisine.

Nature Live is neither an expensive restaurant in the forest or a survival camp for confident campers, but a cuisine glamping experience that offers the opportunity to cook ideal outdoor cuisine yourself and dine well, even if you are a complete beginner. With our unique know-how, guests can cook sensitive ingredients that require precise temperature control and grilling, such as joints of meat, like a professional chef. “Cuisine” in French means “cooking” or “cooking method”, and this kind of glamping with such a focus on food has never been seen before in Japan.

Nature Live is neither an expensive restaurant in the forest or a survival camp for confident campers, but a cuisine glamping experience that offers the opportunity to cook ideal outdoor cuisine yourself and dine well, even if you are a complete beginner. With our unique know-how, guests can cook sensitive ingredients that require precise temperature control and grilling, such as joints of meat, like a professional chef. “Cuisine” in French means “cooking” or “cooking method”, and this kind of glamping with such a focus on food has never been seen before in Japan.

Huis Ten Bosch Project: Regrowth by Brand Planning

Reconstructing the brand and extending the value of Huis Ten Bosch: One year after starting the new system with Katana, Huis Ten Bosch is on track for growth with an aggressive investment campaign based on the new branding, "A Different World of Aspiration."

Huis Ten Bosch, in Sasebo, Nagasaki, is the largest theme park in Kyushu. With its regrowth as a starting point, Katana commenced its branding and operational support for the park in October 2022, with the aim of revitalizing the Kyushu economy and, by extension, the Japanese economy.

Necessary for its re-growth, the brand was redesigned to create a "face" for Huis Ten Bosch that would be chosen by consumers. "A Different World of Aspiration" as a master strategy was developed to transform Huis Ten Bosch into a theme park that stimulates a sense of "opulence" and "luxuriating satisfaction" that consumers cannot experience in their daily lives or at other theme parks.

Huis Ten Bosch, in Sasebo, Nagasaki, is the largest theme park in Kyushu. With its regrowth as a starting point, Katana commenced its branding and operational support for the park in October 2022, with the aim of revitalizing the Kyushu economy and, by extension, the Japanese economy.

Necessary for its re-growth, the brand was redesigned to create a "face" for Huis Ten Bosch that would be chosen by consumers. "A Different World of Aspiration" as a master strategy was developed to transform Huis Ten Bosch into a theme park that stimulates a sense of "opulence" and "luxuriating satisfaction" that consumers cannot experience in their daily lives or at other theme parks.